Is This a Good Time to Buy a Home?

Is the current market affordable, and is it a good time to buy?

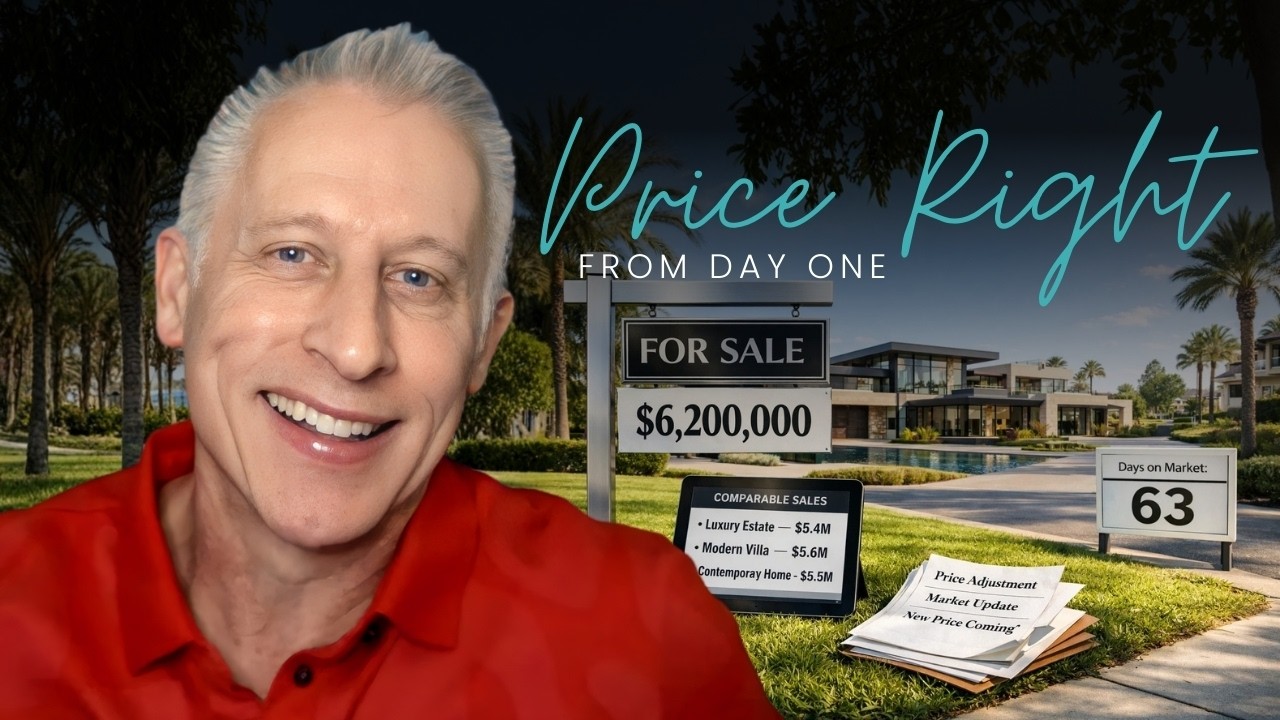

Let’s Explore Your Selling Options. We will help you sell your home at the price and terms you want. Free Strategy Call

Is it a good time to buy a home in today’s housing market? The power lies in the hands of the sellers; rapid appreciation is driving declines in affordability despite rising incomes, and we’re seeing very low mortgage rates. Housing affordability declined in April by 7%, which was the most since December of 2018. Days on the market are at record lows, and multiple-offer bidding wars are common across all price points.

Does this mean it’s a bad time to buy a home? Should a buyer wait for the housing market to cool off or jump in now before affordability declines even further?

Buying a home is both a financial and lifestyle decision. If an individual or a family has made the lifestyle decision to buy, then it becomes a financial question. Will affordability decline in the months to come? If so, it may be a good time to buy before things get worse. However, if buyers start to back off, thereby lowering the likelihood of bidding wars, causing house prices to moderate, and affordability to bounce back, you may want to consider waiting.

Shifts in housing supply or buyer demand can affect affordability. If supply increases and meets demand in the middle, then house prices will moderate. Unfortunately, while inventory has increased slightly in recent weeks, it remains at near historic lows and is not enough to compensate for the decade of underbuilding. It will take years for the supply to catch up to the demand. In the meantime, any new housing inventory will be quickly bought due to existing demand, so significant housing relief is unlikely in the near future.

Another thing that could moderate demand is a substantial increase in mortgage rates. However, without an increase in income or decrease in the house price growth, a rise in mortgage rates is going to accelerate the decline in affordability and squeeze out the buyers that are on the margin out of the market. With these buyers out of the market, there might be less intense and frequent bidding wars, and house pricing may moderate. However, even without the rising mortgage rates, if house price appreciation continues to grow, then that’s going to reduce affordability even further. In the short run, it’s going to squeeze more buyers out of the market.

Household income growth and price appreciation can provide some insight into the likely direction of affordability in April. The nominal house price growth increased by 16.2%. That’s nearly double the 8.6% seen last year. For affordability to improve, house-buying power must outpace nominal house price growth. That’s not happening right now.

Looking ahead, economists forecast mortgage rates to hit 3.4% by the end of 2021. The household income would need to increase by about 5% to offset any affordability loss due to increased mortgage rates. While incomes are expected to increase in the months to come as the economy continues to improve, it’s unclear if it’s going to reach the pace necessary to offset the potential rising mortgage rates.

The bottom line is that while nominal house price growth may moderate due to the affordability squeeze on buyers who are on the margin, the severe supply and demand imbalance means the housing market is unlikely to cool enough to result in a material improvement in affordability. Even if demand moderates due to an affordability squeeze, it will take time for the supply to catch up with demand, which is increasing house price growth.

So should you buy now or wait? Affordability is likely to worsen before it improves, so try to buy now. If you’re a buyer looking for a home in the greater Palm Springs area, we have a lot of experience placing buyers in homes and shepherding them through multiple-offer situations.

We’d be happy to help you as well. Please feel free to just give us a call, text, or email.

-

Let’s Explore Your Selling Options. We will help you sell your home at the price and terms you want. Free Strategy Call

-

Home Value Estimate. Know the value of your property for a cash offer or traditional listing. Request Value

-

Looking for a Palm Springs Home?. Search the entire MLS for your Palm Springs home. Search the MLS

-

Free Newsletter. Get our latest Q&A, insights, and market updates to make smarter decisions. Subscribe Now